Image from NegativeSpace

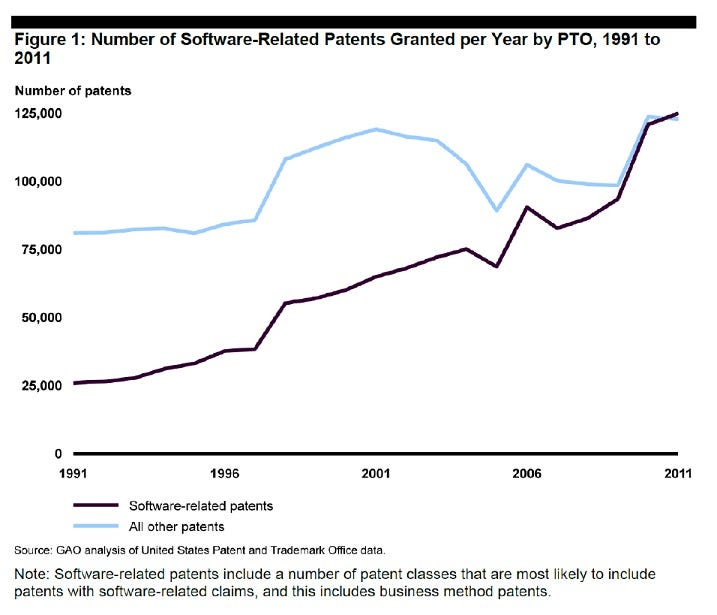

For the last few decades, corporations ranging from startups to large multinationals first turned to utility patents to protect their innovative software. These patents protected everything from the minute details of microprocessor operation (e.g., Intel’s microprocessor power consumption patent) to algorithms for a search engine (e.g.Google/Stanford’s page rank patent) to innovative user interfaces (e.g.,Amazon’s “one-click” patent). In fact, by 2011, patents on software made up more than half of all patents being issued.

The Supreme Court’s June 2014 ruling in Alice v. CLS Bank calls into question the eligibility for patent protection of these issued utility patents on computer software, and is a barrier to future applications on computer software. Alice and its progeny compel software developers to look beyond patents to protect their intellectual property. What are these alternatives? When and how can they be used? Continue Reading Courts Everywhere are Finding Software Patents Invalid, So What Next?

There are two trends increasing the costs of patent litigation.

There are two trends increasing the costs of patent litigation.